51+ what percentage of my income should my mortgage be

Get Your VA Loan. Principal interest taxes and insurance collectively known as PITI.

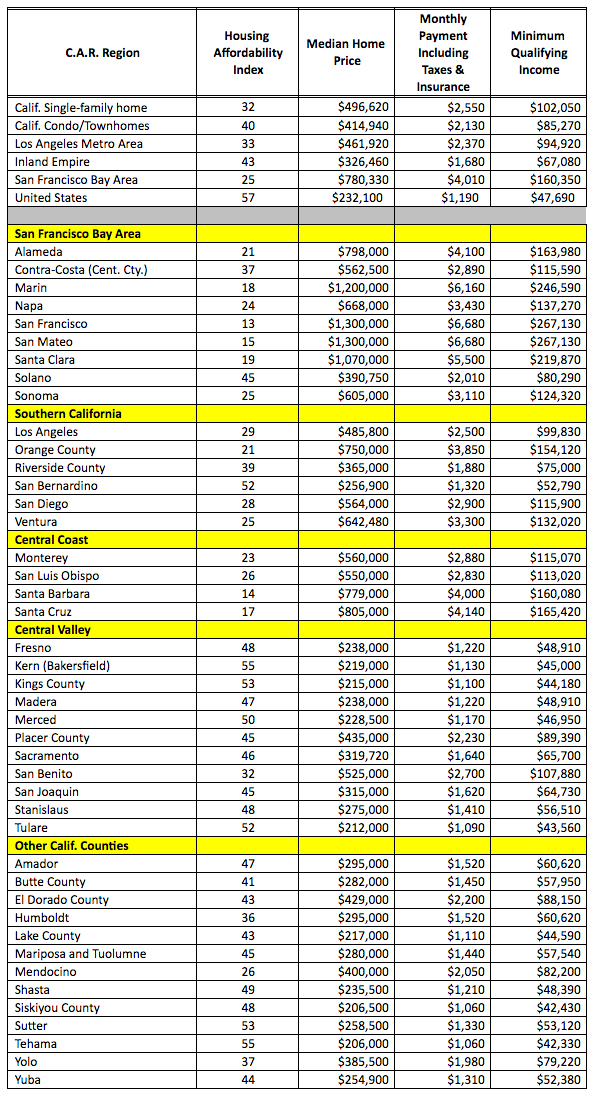

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre.

. The 28 Percent Rule In. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Fast VA Loan Preapproval.

Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. To afford a 400000 house borrowers need 55600 in cash to put 10 percent down. With a 30-year mortgage.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Ad Compare Home Financing Options Online Get Quotes.

Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment. Check Your Official Eligibility Today. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender.

Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. Gross income is your income before any deductions or taxes are. And you should make.

Web Lenders want your back-end DTI to be no higher than 43 to 50 depending on the type of mortgage youre applying for and other aspects of your. However how much you. Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford.

Web What percentage of your monthly income should go to mortgage. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

John in the above example makes. Trusted VA Loan Lender of 300000 Veterans Nationwide. Save Time Money.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. The 28 rule The 28 mortgage rule states that you should spend 28 or less. Updated FHA Loan Requirements for 2023.

Web A good rule of thumb when considering how much of your income should go toward your mortgage is 28 percent of your gross income. Ad Take the First Step Towards Your Dream Home See If You Qualify. Ad Top Home Loans.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Compare More Than Just Rates. A lender suggests to not.

Contact a Loan Specialist. Web A 15-year term. Find A Lender That Offers Great Service.

Find A Lender That Offers Great Service. Get Your Home Loan Quote With Americas 1 Online Lender. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. How Home Mortgage Helps To Buy A House.

Web What income is required for a 400k mortgage. Web Total monthly mortgage payments are typically made up of four components. Compare More Than Just Rates.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. For example if your monthly income is 5000 you can. Ad Looking For Home Mortgage Rates.

Web This rule says that you should not spend more than 28 of your gross income on your mortgage payment. Web Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

VA Loan Expertise Personal Service.

Mortgage Calculator Free House Payment Estimate Zillow

How Much House Can You Afford Readynest

51 Se Harbor Point Dr Stuart Fl 34996 Realtor Com

2245 Sw Trailside Path Stuart Fl 34997 Zillow

825 Sw Lighthouse Dr Palm City Fl 34990 Zillow

How Much Mortgage Can I Get For My Salary Martin Co

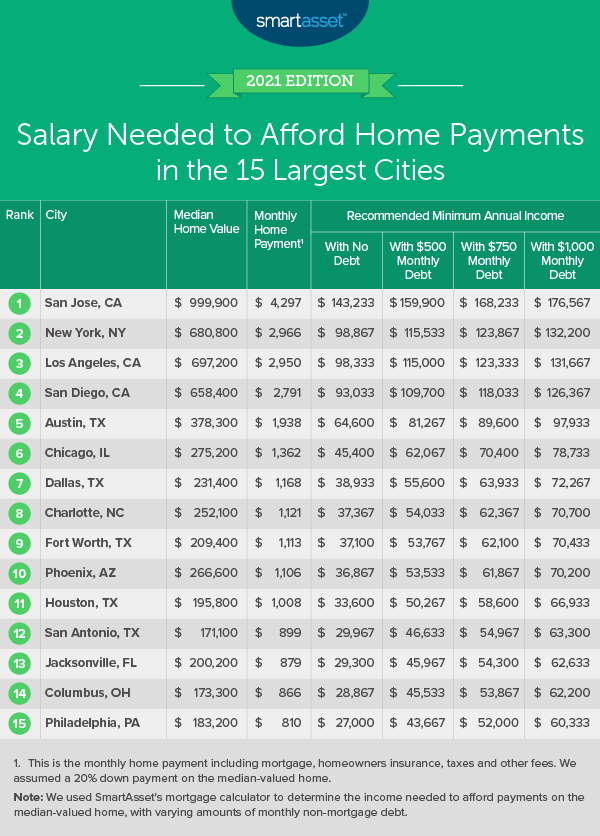

What Must You Earn To Afford A Chicago Home Payment Chicago Agent Magazine Local News

126k 31 28 No

587 Park Plz Glen Ellyn Il 60137 Mls 10055434 Redfin

51 Se Sedona Cir Apt 102 Stuart Fl 34994 Realtor Com

Here S How To Figure Out How Much Home You Can Afford

51 Se Harbor Point Dr Stuart Fl 34996 Realtor Com

The Percentage Of Income Rule For Mortgages Rocket Money

The Percentage Of Income Rule For Mortgages Rocket Money

1117 E 13th St Carthage Mo 64836 Zillow

4807 Opal Rd Golden City Mo 64748 Mls 225049 Trulia

Affordability Calculator How Much House Can I Afford Zillow